When my third money coaching client said, “I’ve just read this book on ‘tidying’ and I think it’s connected to money somehow.” I got very curious. “Tidying?” Yes. Literally a book about decluttering and organizing your space – and they were all raving about it. (Ummm…were they really raving about a book on tidying?)

When my third money coaching client said, “I’ve just read this book on ‘tidying’ and I think it’s connected to money somehow.” I got very curious. “Tidying?” Yes. Literally a book about decluttering and organizing your space – and they were all raving about it. (Ummm…were they really raving about a book on tidying?)

Suffice it to say, I bought the book. It’s called The Life-Changing Magic of Tidying Up: The Japanese Art of Decluttering and Organizing, by Marie Kondo. And it truly is a #1 New York Times best seller (with more than three million copies sold).

In it, Kondo teaches you exactly how to discard what no longer brings you joy, until you are only left with the possessions you truly want to surround yourself with. Then, she explains how to organize those items within your space. If you do this using her methodology, she promises you’ll never “relapse” – you’ll never again come home to energy-depleting clutter. And more than that, if you put your house in order, you will no longer be distracted or weighed down by your stuff.

Sometimes our “stuff” is a part of who we used to be and the life we used to have before we divorced, or it can be related to what we think we should be. Perhaps these things are simply vestiges from old relationships. Letting go of the items that don’t tie in to who you really are now will allow what is truly “you” to remain. The “magic” that comes from tidying will enable you to discover what you want to do next in your life.

It makes sense, doesn’t it? If you teach yourself to understand what really gives you joy – and only surround yourself with those items – you get in touch at a very deep level with who you truly are. And as Kondo writes, “The question of what you want to own is actually the question of how you want to live your life.”

Now what does this have to do with your money?

I find that when I first meet clients, they have a lot of financial clutter that weighs on them. And when we “declutter” their finances, they feel lighter and freer, so our work can go to a deeper level. They begin to get clear on who they are and what they really want.

The Clutter of Multiple Accounts

At the first session with a new client, I get out a piece of paper and literally draw a picture of all their accounts: checking, savings, credit cards, etc. Then I draw out how they are connected – how the money flows from one place to another.

You should see the large messes that begin to take shape on this paper. Money is transferred partly to this account and then some to that account. Some bills are paid out of certain accounts, while other accounts are used for discretionary spending. Some things are auto-debited and others seem to get lost in the cracks with late fees. But then when accounts don’t have enough money, money is transferred back and forth, with credit card accounts taking up the slack, and then being paid for as best people can.

Eventually, we sit back and look at my drawing with all its lines, circles, and arrows.

“No wonder you are feeling frustrated,” I often say. Seeing their financial life this way usually creates one of the first lightbulbs. The more accounts a person has, the more “clutter” there is.

Simpler is better.

In my personal life, I use one primary checking account. I never have a question of how much money I have or if I can pay a bill. I simply put everything through one account. That way, I can focus on more important things – like how to use my money to make me happy and move towards my goals.

The initial act of “tidying” I ask clients to consider is to stop using so many accounts and begin to close ones that are no longer being used. My most successful clients have very few accounts (many do well with one checking account and one credit account). Remember, the goal is not to come up with elaborate ways to move our money around. It’s to create a happy life now, and a secure future later.

Messy Unexamined Expenses

Once you cut down on the “account clutter,” you can begin to clearly see what you spend. (It’s very difficult to see what you spend when the payments come from five different places.)

And often, we find that some expenses are simply left over from a previous relationship, or they no longer “fit” in someone’s life for various reasons.

One client never watched Netflix, but it still came out of her account, a remnant from her ex-husband who was a movie buff. Another client was a member of a wine club, but when we examined this expense, she realized it was really a hobby she had inherited from her ex. There are many layers of saying goodbye in a divorce. You may need to say goodbye to expenses that no longer make sense in your new life.

And yes, sometimes expenses simply don’t “fit” in your new single life. Hard choices need to be made. Often, people need to spend less to reflect a single income. You may need to simplify. But is this always bad? When we declutter and organize our homes, it feels sooo good. Reframing your new life as a chance to simplify and streamline can make a big difference in your outlook.

Marie Kondo writes, “The process of assessing how you feel about the things you own, identifying those that have fulfilled their purpose, expressing gratitude, and bidding them farewell, is really about examining your inner self – a rite of passage to a new life.”

And while she was not talking about your new life after divorce, she very well could have been.

Under the Clutter

Often, financial clutter can mask real fears and concerns, keeping us distracted. Just like when you finally unclutter a room, when you declutter your financial life, it is easier to see what is really going on. You can uncover what is working, what is not, and where you really want to go.

Unexamined financial affairs keep us locked in stressful financial cycles, with no time or energy to delve into deep questions that might provoke real change.

The good news is, when we discard accounts and let go of expenses that no longer suit who we are, then the next phase of the work begins. As Kondo writes, “[Tidying] allows you to confront the issues that are really important. Tidying is just a tool, not the final destination. The true goal should be to establish the lifestyle you want most once your house has been put in order.”

How wonderful to discover, and start working towards, the kind of life you truly want.

Want more help transforming your relationship to money? Check out all the eBooks, audios, and more robust products Mikelann has created. Are you ready to break free of the “money fog” and step into earning what you are worth? Are you are ready to get in touch with your emotions so you never feel out of control around money again? Are you ready to love your financial life? Let Mikelann help you get there. Free items are at the top of the page.

As a money coach, I ask new clients about their relationship to food.

As a money coach, I ask new clients about their relationship to food.

“If we could sell our experiences for what they cost us we’d be millionaires” – Abigail Van Buren

“If we could sell our experiences for what they cost us we’d be millionaires” – Abigail Van Buren

Recently I read Big Magic by Elizabeth Gilbert, author of Eat Pray Love. I gobbled it up like candy. It’s on how to live a creative life- whatever that looks like for YOU—and how to invite in inspiration. And she does not leave money out of the conversation. Personally, I’ve always been frustrated with the “Do what you love and the money will follow” and the “Follow your bliss” school of thought. I think Gilbert would agree. So while her book is not about money, I loved some of her thoughts on it that she wove in. I wrote an op/ed piece on the subject for

Recently I read Big Magic by Elizabeth Gilbert, author of Eat Pray Love. I gobbled it up like candy. It’s on how to live a creative life- whatever that looks like for YOU—and how to invite in inspiration. And she does not leave money out of the conversation. Personally, I’ve always been frustrated with the “Do what you love and the money will follow” and the “Follow your bliss” school of thought. I think Gilbert would agree. So while her book is not about money, I loved some of her thoughts on it that she wove in. I wrote an op/ed piece on the subject for

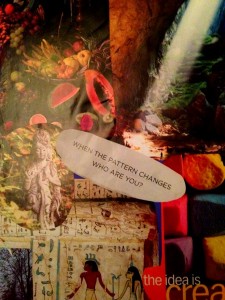

Back in the fall, while on a trip with a girlfriend, I was leafing through a magazine and came across an odd advertisement which said, “Who are you when the pattern changes?”

Back in the fall, while on a trip with a girlfriend, I was leafing through a magazine and came across an odd advertisement which said, “Who are you when the pattern changes?”