At fifty-one, Christine was tired of being stressed about money.

At fifty-one, Christine was tired of being stressed about money.

She had worked as a corporate coach since her early thirties. Now, it was coming on almost two decades that she had worked with large companies on organizational change. She was very good at her job and generally felt she was well paid. Her income had grown over the years. But at night when sleep refused to come, she’d worry about the future. Would she always have to work so many hours? Would she be able to pull back and enjoy her garden more? Images of her old, faded couch came to mind. She loved being at home, her sweet nest, but the couch she really wanted cost thousands. And her son was asking for ski lessons, another big expense. She kept avoiding talking about it with him. And how about a real vacation?…

She felt fear over the future, overwhelm about figuring out how to afford her increasingly expensive life, and guilt over not giving her son what she thought could be a healthy activity for him. Income, outgo—how to get it all to work? Her mind whirling, sleep did not come.

Fear, Overwhelm, Guilt. F.O.G.

Christine was suffering from money fog.

What is money fog? At its simplest, it’s the feelings of stress and anxiety caused by financial vagueness.

More specifically, it’s when we feel fear, overwhelm, and/or guilt (F.O.G.) as a result of being out of touch with the money in our life—in other words, not being clear, confident, and in control of the money coming in and going out.

Said another way, the money fog is the feelings caused by being financially hazy.

Are you in a money fog? Let’s find out.

Here are ten questions to help you discern if you are in a money fog. Circle yes or no:

- Do you ever feel frustrated and wonder, “Where did it all go?” YES or NO

- Do you feel fear or anxiety when you think of your money? YES or NO

- Do you ever feel guilty when you reflect on something you bought? YES or NO

- Do you know where all your money really goes? For example, do you know what you spend on clothes, eating out, and vacations? Do you know what your home really costs you? YES or NO

- Do you have a system for tracking what you spend? YES or NO

- Do you know how much money you need each month to live comfortably and avoid consumer debt? YES or NO

- Do you know how much money you need to earn annually to cover the entire year in a satisfying way, including retirement savings? YES or NO

- Do you know your net worth? YES or NO

- Do you feel in control of your personal finances? YES or NO

- Does money feel like a sacred tool to help you create your best life? YES or NO

Count the number of “yes” answers for questions 1–3. Answer _____

Count the number of “no” answers for questions 4-10. Answer _____

Add the numbers. If your score is more than 4, you are likely suffering from some level of money fog.

While I hope you’re happy with your score, chances are you identify with some level of money fog. The dilemma with money fog is that people can often only identify it by the hidden impact it has on their life.

When we are in a fog, we are not fully aware of it. We sense things are dim. And we will drive slowly if we are in a fog, trying to avoid hitting something, barely able to see the road ahead of us. We do not excitedly plan the adventures ahead of us if we are driving in a fog. Rather, it takes all our internal resources merely to cling to the road and try to keep safe. But it’s not until we drive out of the fog that we become aware of just how thick it is.

Money fog is essentially a cloud sitting on the ground of our lives—a murky condition that reduces visibility. When we’re unclear about what we can afford or how much we really need to earn, this fog causes confusion, frustration, and bewilderment. Money fog also keeps us from seeing what might be possible further down the road.

Think about it like flow.

The money fog arises when you aren’t in touch with the FLOW of money. This flow is like a tide coming in and going out. Income comes in: earned income, rental income, child support, trust income, dividend income, and so on. Expenses go out. Oh the outgo of expenses! From monthly expenses like groceries and utility bills to the never-ending pop of “periodic expenses” such as airplane tickets, car repairs, and home remodels. Are you clear about this flow? Are you in charge of it, or is it just happening? Are you confident in how you handle this flow? Do you feel in control of your money and your life? Or are you sometimes overwhelmed by the flow?

Money as a sacred resource

As a rule, women don’t really care about money for the sake of money. It’s not a game in which we enjoy keeping score and stockpiling money for the sake of looking at it. Rather, it’s about what we can do with this resource. Yes, money is a sacred resource, and yes, it is energy and power. It is a potent energy with the power to give you what you truly desire in life. However, it is not about the money but rather what you can do with it. Money can help us live our dreams, deeply enjoy our life, take care of our children, secure our future, and donate to causes that touch our heart. This is the power of money. And money fog blocks this power.

You want to use this power to live your best life. When you feel stressed and depleted, which the money fog causes, it’s harder to attend to deeper matters like your spiritual growth. When you’re trying to relax into meditation after your yoga practice and you find yourself “running numbers” in your head or making a mental note to transfer money between accounts, these thoughts and worries are not very conducive to higher states.

When you feel financially constricted, overwhelmed, or stressed, these feelings can affect you emotionally and spiritually, robbing you of energy. The money fog also stifles inspiration. When money causes stress or simply takes up a lot of headspace, your creativity can become blocked. It is more difficult to write, paint, dance, and express yourself in the world when you are engulfed in the money fog.

But it does not have to be this way. Naming a problem goes a long way towards solving it. Once you realize you are in a money fog, you can begin to rise above it.

We all deserve to step into living fuller lives—filled with meaning, joy, and purpose. Once out of the fog, people can more easily step into new chapters, explore their own purpose, and entertain new adventures and possibilities in their lives. Without the money fog clinging to us and obscuring our vision, we can finally see new paths before us.

~~~

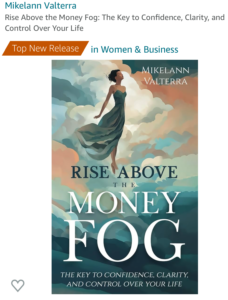

This article is based on Mikelann Valterra‘s latest book, Rise Above the Money Fog—The key to confidence, clarity, and control over your life. The book explores the hidden impact of money fog in our lives through the stories of four women, the psychology of where money fog comes from, and what it takes to rise above it. To order, see www.riseabovethemoneyfog.com

Great news! My new book Rise Above the Money Fog, the key to confidence, clarity, and control over your life, launched this week on Amazon. I am happy to say it earned the top new release in both Amazon’s finance category AND women and business! Wow. I am over the moon. I want to thank everyone who has purchased a copy and a special thank you to the readers who shared their reviews on Amazon. It feels so good to see this book in the world, after a lot of hard work. At only 100 pages, it is short but powerful. May it help women rise above the money fog and step into their true potential!

Great news! My new book Rise Above the Money Fog, the key to confidence, clarity, and control over your life, launched this week on Amazon. I am happy to say it earned the top new release in both Amazon’s finance category AND women and business! Wow. I am over the moon. I want to thank everyone who has purchased a copy and a special thank you to the readers who shared their reviews on Amazon. It feels so good to see this book in the world, after a lot of hard work. At only 100 pages, it is short but powerful. May it help women rise above the money fog and step into their true potential!

At fifty-one, Christine was tired of being stressed about money.

At fifty-one, Christine was tired of being stressed about money.

It’s not your imagination—most of us grew up hearing very little about money. The result of this childhood omission is… the money fog.

It’s not your imagination—most of us grew up hearing very little about money. The result of this childhood omission is… the money fog.

I loved this half hour conversation with Junie Moon – a relationship coach who works with women on creating an amazing “second act” in their love life. We had a fabulous conversation on how to navigate divorce, what it is like to be single with money, and then how it feels to recombine at some level with a new love. I shared my own story of divorce and finding love again. How does a money coach “do money” when she gets married in her fifties? Listen in and find out.

I loved this half hour conversation with Junie Moon – a relationship coach who works with women on creating an amazing “second act” in their love life. We had a fabulous conversation on how to navigate divorce, what it is like to be single with money, and then how it feels to recombine at some level with a new love. I shared my own story of divorce and finding love again. How does a money coach “do money” when she gets married in her fifties? Listen in and find out.

I guested on Guts, Grit & Great Business, with attorney Heather Pierce Campell. She is a fabulous business attorney who knows first-hand how stressed business owners can be when it comes to finances and running their business. Her job is to protect her clients. But how to help their financial stress? We talked about why talking about money is so hard, and how this starts for many of us in our childhoods. And we discussed the importance of putting together your own money team. We also dove into the fact that many business owners don’t know how much they need to make. How do they figure this out? And yes, we talked about the importance of sharing our money story and forgiving ourselves for past money mistakes.

I guested on Guts, Grit & Great Business, with attorney Heather Pierce Campell. She is a fabulous business attorney who knows first-hand how stressed business owners can be when it comes to finances and running their business. Her job is to protect her clients. But how to help their financial stress? We talked about why talking about money is so hard, and how this starts for many of us in our childhoods. And we discussed the importance of putting together your own money team. We also dove into the fact that many business owners don’t know how much they need to make. How do they figure this out? And yes, we talked about the importance of sharing our money story and forgiving ourselves for past money mistakes.

I sat down with Nicole

I sat down with Nicole

I loved this half hour chat with Andrea, from Lead Like a Woman podcast. I shared the story of how I became a money coach, and why marrying the practical with the emotional side of money is so powerful. We also talked about how to make money FUN, and how to protect what you truly want, as opposed to keeping up with the Jones. And as always, we sprinkled in talk of tango, my other favorite topic.

I loved this half hour chat with Andrea, from Lead Like a Woman podcast. I shared the story of how I became a money coach, and why marrying the practical with the emotional side of money is so powerful. We also talked about how to make money FUN, and how to protect what you truly want, as opposed to keeping up with the Jones. And as always, we sprinkled in talk of tango, my other favorite topic.

Host Denise Vivaldo asked me back to her awesome podcast—Women beyond a certain age. The topic? How to beautify your money! Here is what I told Denise: “Beauty makes me feel like I am really living and savoring my life. So why would this be less true in our money and financial life? I want my financial life to be beautiful as well. I want to bring beauty to my money! Otherwise, it is a place of clutter and disorder (and conveys an internal message that I don’t care or honor my money—so really—since I haven’t made it a nice home, why should it stick around??!) Without beauty, my money life feels like that back kitchen drawer I resist opening, or the closet we have crammed full of stuff… So, we stay away…!”

Host Denise Vivaldo asked me back to her awesome podcast—Women beyond a certain age. The topic? How to beautify your money! Here is what I told Denise: “Beauty makes me feel like I am really living and savoring my life. So why would this be less true in our money and financial life? I want my financial life to be beautiful as well. I want to bring beauty to my money! Otherwise, it is a place of clutter and disorder (and conveys an internal message that I don’t care or honor my money—so really—since I haven’t made it a nice home, why should it stick around??!) Without beauty, my money life feels like that back kitchen drawer I resist opening, or the closet we have crammed full of stuff… So, we stay away…!”

Susan Rosin (

Susan Rosin (

Angie Garner, of the Angie Garner podcast, and I talked about the “wild west” of finance these days. So many different payment apps and ways to “do” money. The answer lies in simplifying. Angie and I also talked about families and money. “Lifestyle bloat” makes us feel like we are spending and spending on our lifestyle but our income doesn’t seem to keep up. What is the answer? And last, we talked about brain chemistry and money. What happens in the brain when you spend on things you like, and end up overspending? What is the answer? Listen in and find out.

Angie Garner, of the Angie Garner podcast, and I talked about the “wild west” of finance these days. So many different payment apps and ways to “do” money. The answer lies in simplifying. Angie and I also talked about families and money. “Lifestyle bloat” makes us feel like we are spending and spending on our lifestyle but our income doesn’t seem to keep up. What is the answer? And last, we talked about brain chemistry and money. What happens in the brain when you spend on things you like, and end up overspending? What is the answer? Listen in and find out.